Imagine a scenario where your home, your sanctuary, could be at risk due to unforeseen circumstances like debt or legal judgments. The thought alone can be unsettling, right? But what if I told you there's a simple, yet powerful, tool available to safeguard your most valuable asset?

The worries associated with potential financial hardships can be overwhelming. The fear of losing your home, the place where memories are made and futures are planned, can weigh heavily on anyone's mind. Navigating complex legal jargon and understanding your rights can feel like an uphill battle, especially when you're already facing difficult times. The uncertainty and stress can take a significant toll on your well-being and peace of mind.

This article aims to shed light on a crucial protection for homeowners: the Homestead Declaration. It's a legal document that, in many states, allows you to shield a portion of your home's value from certain creditors. By understanding and utilizing this declaration, you can secure your family's stability and preserve your home as a safe haven, regardless of life's unexpected challenges.

In essence, understanding the Homestead Declaration is about securing your future and safeguarding your family's most important asset: your home. We'll explore what it is, why it matters, how to file it, and what benefits it provides. By taking this proactive step, you can gain peace of mind knowing that you've taken steps to protect your home from potential financial pitfalls.

My Personal Encounter with Home Protection

Years ago, a close friend of mine faced a challenging situation. A business venture went sour, leaving him with significant debt. The stress was immense, and the possibility of losing his home loomed large. It was during this difficult time that I learned about the Homestead Declaration. We researched the laws in our state, consulted with a real estate attorney, and filed the declaration. The relief on my friend's face when he realized the significant portion of his home's equity was protected was palpable. It was a powerful reminder of the importance of understanding and utilizing the legal protections available to homeowners. The Homestead Declaration isn't a magic bullet, but it offered a crucial safety net during a turbulent period. It allowed him to focus on rebuilding his business without the constant fear of losing everything. This personal experience solidified my belief that every homeowner should be aware of this vital protection. The Homestead Declaration provides a layer of defense against creditors, shielding a specific amount of your home's equity from being seized to satisfy debts. The amount of protection varies by state, but it can be substantial, potentially saving your home from foreclosure in times of financial hardship. Beyond the financial aspect, the Homestead Declaration offers peace of mind. Knowing that your home is protected allows you to focus on overcoming challenges without the added worry of losing your shelter.

What Exactly is a Homestead Declaration?

The Homestead Declaration is a legal document that a homeowner files with their local government (usually the county recorder's office) to protect a portion of their home's equity from certain creditors. It's designed to safeguard your primary residence from being seized to satisfy debts such as credit card debt, medical bills, or personal loans. The specific protections and limitations vary significantly from state to state. Some states offer automatic homestead protection, meaning you don't need to file a declaration to receive the benefit. Others require you to actively file the declaration to claim your protection. The amount of equity protected also varies. Some states offer relatively small exemptions, while others offer very generous protections that can shield a significant portion of your home's value. It's important to remember that the Homestead Declaration typically doesn't protect against foreclosure for non-payment of your mortgage or property taxes. These are considered secured debts, and the lender or government has a priority claim on your property. The Homestead Declaration is a crucial tool for protecting your home from unsecured debts. It can provide a much-needed buffer during times of financial difficulty, allowing you to retain your home and rebuild your finances. However, it's essential to understand the specific laws in your state and consult with a legal professional to ensure you're properly protected.

The History and Myths Surrounding Homestead Declarations

The concept of homestead protection dates back to ancient times, with roots in Roman law and Anglo-Saxon common law. The idea was to ensure that families had a place to live, regardless of their financial circumstances. In the United States, the Homestead Act of 1862 played a significant role in shaping the landscape of homeownership. This act granted 160 acres of public land to settlers who agreed to live on and cultivate the land for five years. While the Homestead Act primarily focused on land distribution and agricultural development, it also instilled the principle of protecting a family's home and livelihood. Over time, states began enacting their own homestead laws to protect homeowners from creditors. These laws varied widely in terms of the amount of protection offered and the procedures for claiming it. There are several myths surrounding the Homestead Declaration. One common misconception is that it protects against all debts. In reality, it typically only protects against unsecured debts, not secured debts like mortgages or property taxes. Another myth is that the Homestead Declaration is a foolproof way to avoid foreclosure. While it can provide a valuable layer of protection, it's not a guarantee. If you fall behind on your mortgage payments, the lender can still foreclose on your property, regardless of whether you have filed a Homestead Declaration. Understanding the history and dispelling the myths surrounding Homestead Declarations is crucial for homeowners. It allows you to make informed decisions about protecting your home and to understand the limitations of this legal tool.

The Hidden Secrets of the Homestead Declaration

One of the lesser-known aspects of the Homestead Declaration is its potential impact on estate planning. In some states, the Homestead Declaration can affect how your property is transferred upon your death. For example, it may grant certain rights to your surviving spouse or minor children, even if your will specifies otherwise. This can be particularly important in blended families or situations where you want to ensure that your loved ones are protected. Another hidden secret is the importance of timely filing. In some states, you must file the Homestead Declaration before a judgment is entered against you to receive its protection. If you wait until after a creditor has obtained a judgment, it may be too late to claim the exemption. This underscores the importance of being proactive and filing the declaration as soon as you become a homeowner. The Homestead Declaration can also have implications for bankruptcy proceedings. In some cases, the Homestead Exemption can protect a significant portion of your home's equity from being seized by creditors in a bankruptcy case. This can be a lifeline for homeowners facing financial difficulties, allowing them to keep their home and rebuild their finances. Understanding these hidden secrets of the Homestead Declaration can empower you to make informed decisions about protecting your home and your family's future. Consulting with an attorney or financial advisor can help you navigate the complexities of these laws and ensure that you're taking full advantage of the available protections. It is imperative to understand that laws are changing so you will want to ensure the information you get is from a legal professional, or government website.

Recommendations for Homestead Declaration

My top recommendation is to research your state's specific homestead laws. Each state has its own unique rules and regulations regarding the Homestead Declaration, including eligibility requirements, exemption amounts, and filing procedures. Visit your state's official government website or consult with a real estate attorney to get accurate and up-to-date information. Another crucial recommendation is to file the Homestead Declaration as soon as you become a homeowner. Don't wait until you're facing financial difficulties to take this step. Filing early ensures that you're protected from the moment you become eligible. I also recommend that you carefully review the Homestead Declaration form and ensure that you understand all of the terms and conditions. If you have any questions or concerns, don't hesitate to seek legal advice. An attorney can help you complete the form correctly and ensure that you're properly protected. Finally, I recommend that you keep a copy of your filed Homestead Declaration in a safe place. This will serve as proof that you have claimed the exemption and can be useful in the event of a dispute with a creditor. By following these recommendations, you can take proactive steps to protect your home and your family's financial future. The Homestead Declaration is a valuable tool that can provide peace of mind and financial security, especially during challenging times. As a realtor I can tell you I have recommended the Homestead Declaration many times!

Understanding State-Specific Homestead Laws

The nuances of homestead laws vary drastically from state to state, making it crucial to understand the specific regulations in your jurisdiction. For example, some states offer automatic homestead protection, meaning you don't need to file any paperwork to claim the exemption. In these states, the protection is automatically applied to your primary residence. Other states require you to actively file a Homestead Declaration form with your local government (usually the county recorder's office) to claim the exemption. The amount of equity protected by the Homestead Declaration also varies significantly. Some states offer relatively small exemptions, such as $25,000 or $50,000, while others offer more generous protections that can shield hundreds of thousands of dollars of your home's equity. Some states also have acreage limitations, specifying the maximum size of the property that can be protected under the Homestead Declaration. It's important to understand these limitations to ensure that your entire property is covered. In addition to the exemption amount and acreage limitations, states may also have specific requirements regarding residency and occupancy. For example, you may be required to occupy the property as your primary residence to claim the homestead exemption. Understanding these state-specific requirements is essential to ensure that you're eligible for the protection.

Tips for Successfully Filing Your Homestead Declaration

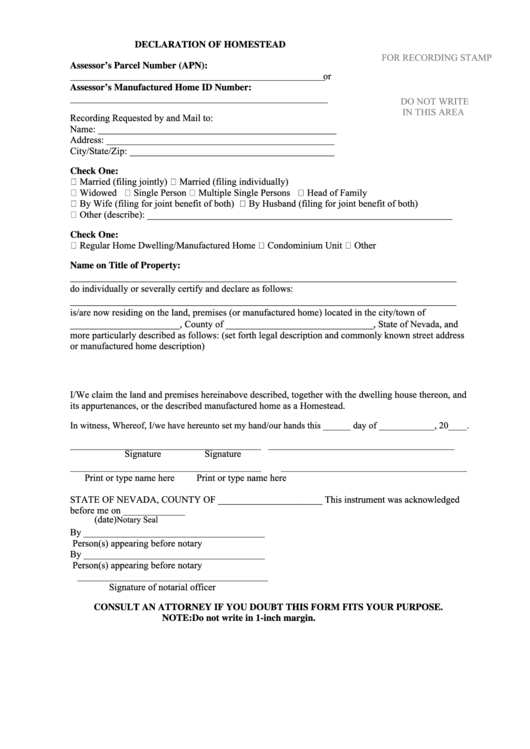

First and foremost, obtain the correct Homestead Declaration form for your state. You can usually find this form on your local government's website or at the county recorder's office. Make sure you're using the most up-to-date version of the form to avoid any potential issues. Carefully read the instructions on the form and follow them precisely. The instructions will guide you through the process of completing the form and provide important information about eligibility requirements and filing procedures. Provide accurate and complete information on the form. Any errors or omissions could delay the processing of your application or even result in denial of the exemption. Be sure to include your full legal name, property address, and any other information requested on the form. Gather all necessary documentation, such as a copy of your deed or property tax bill. These documents may be required to verify your ownership of the property and your eligibility for the Homestead Declaration. File the completed form with the appropriate government office. In most cases, this will be the county recorder's office in the county where your property is located. Be sure to pay any required filing fees. Keep a copy of the filed form and any supporting documentation for your records. This will serve as proof that you have claimed the Homestead Declaration and can be useful in the event of a dispute with a creditor. Consider seeking legal advice from a qualified attorney. An attorney can help you understand the Homestead Declaration process, ensure that you're eligible for the exemption, and assist you with completing the form correctly.

Understanding the Impact on Estate Planning

The Homestead Declaration can have a significant impact on your estate plan, particularly in terms of how your property is transferred upon your death. In some states, the Homestead Declaration grants certain rights to your surviving spouse or minor children, even if your will specifies otherwise. For example, the surviving spouse may have the right to continue living in the home for the rest of their life, regardless of what your will states. Similarly, minor children may have the right to inherit the home, even if you have designated other beneficiaries in your will. These homestead rights can override your testamentary wishes and create unintended consequences for your estate plan. It's important to understand these potential conflicts and to take steps to address them in your estate planning documents. You may need to revise your will or trust to ensure that your wishes are carried out while also respecting the homestead rights of your surviving spouse and children. Consulting with an estate planning attorney is essential to navigate these complexities and to create a comprehensive estate plan that protects your assets and provides for your loved ones. The attorney can help you understand the homestead laws in your state and advise you on how to best integrate them into your estate plan. They can also help you draft the necessary legal documents to ensure that your wishes are clearly expressed and legally enforceable.

Fun Facts About Homestead Declarations

Did you know that the Homestead Act of 1862, which granted free land to settlers, played a significant role in shaping the concept of homestead protection in the United States? This act encouraged westward expansion and provided families with the opportunity to own their own land, laying the foundation for the modern-day Homestead Declaration. Another fun fact is that the amount of equity protected by the Homestead Declaration can vary dramatically from state to state. In some states, the exemption is relatively small, while in others, it can be quite substantial, potentially shielding hundreds of thousands of dollars of your home's value. The Homestead Declaration is not just for single-family homes. It can also apply to other types of properties, such as condominiums, mobile homes, and even boats, as long as they are used as your primary residence. The Homestead Declaration is a powerful tool for protecting your home from creditors, but it's not a magic bullet. It typically only protects against unsecured debts, not secured debts like mortgages or property taxes. It's essential to understand the limitations of the Homestead Declaration and to take other steps to protect your financial well-being. The Homestead Declaration is a testament to the importance of homeownership and the desire to protect one's family and property. It's a legal mechanism that provides peace of mind and financial security to homeowners across the country. As a realtor I can say the peace of mind is well worth the effort!

How to File a Homestead Declaration

Filing a Homestead Declaration is typically a straightforward process, but it's important to follow the steps carefully to ensure that your application is approved. The first step is to obtain the correct Homestead Declaration form for your state. You can usually find this form on your local government's website or at the county recorder's office. Carefully read the instructions on the form and follow them precisely. The instructions will guide you through the process of completing the form and provide important information about eligibility requirements and filing procedures. Provide accurate and complete information on the form. Any errors or omissions could delay the processing of your application or even result in denial of the exemption. Be sure to include your full legal name, property address, and any other information requested on the form. Gather all necessary documentation, such as a copy of your deed or property tax bill. These documents may be required to verify your ownership of the property and your eligibility for the Homestead Declaration. File the completed form with the appropriate government office. In most cases, this will be the county recorder's office in the county where your property is located. Be sure to pay any required filing fees. Keep a copy of the filed form and any supporting documentation for your records. This will serve as proof that you have claimed the Homestead Declaration and can be useful in the event of a dispute with a creditor. Consider seeking legal advice from a qualified attorney. An attorney can help you understand the Homestead Declaration process, ensure that you're eligible for the exemption, and assist you with completing the form correctly. This is particularly important if you have any complex legal or financial issues.

What If I Don't File a Homestead Declaration?

If you live in a state that requires you to file a Homestead Declaration to receive the protection, failing to do so could leave your home vulnerable to creditors. Without the Homestead Declaration, a portion of your home's equity could be seized to satisfy debts such as credit card debt, medical bills, or personal loans. This could put your home at risk of foreclosure and leave you and your family without a place to live. Even if you live in a state that offers automatic homestead protection, it's still a good idea to understand the rules and regulations. The automatic protection may not cover all of your home's equity, or it may have certain limitations. By understanding the law, you can make informed decisions about protecting your home and your financial future. It's important to note that the Homestead Declaration does not protect against all types of debts. It typically only protects against unsecured debts, not secured debts like mortgages or property taxes. If you fall behind on your mortgage payments or property taxes, the lender or government can still foreclose on your property, regardless of whether you have filed a Homestead Declaration. The Homestead Declaration is a valuable tool for protecting your home from creditors, but it's not a substitute for responsible financial management. It's important to manage your debts carefully and to avoid taking on more debt than you can afford. If you're struggling with debt, seek professional help from a financial advisor or credit counselor. They can help you develop a budget, negotiate with creditors, and explore other options for resolving your debt problems. They can also help with the Homestead Declaration process.

Listicle: Top Benefits of Filing a Homestead Declaration

Here is a short list about top benefits of filing a Homestead Declaration: Protection from Creditors: Shields a portion of your home's equity from being seized to satisfy certain debts, providing financial security and peace of mind. Preservation of Family Home: Ensures that your family can remain in their home, even in the face of financial difficulties, preserving stability and continuity. Estate Planning Advantages: Can impact how your property is transferred upon death, potentially granting rights to surviving spouse or minor children, regardless of your will. Bankruptcy Protection: Can protect a significant portion of your home's equity from being seized by creditors in a bankruptcy case, offering a lifeline during challenging times. Peace of Mind: Provides reassurance and reduces stress by knowing that your home is protected from certain financial risks, allowing you to focus on other priorities. Potential Tax Benefits: In some states, filing a Homestead Declaration can also qualify you for property tax exemptions, reducing your overall tax burden. Safeguarding Your Investment: Protects your largest asset, your home, from potential loss, preserving your investment and long-term financial security. Legal Protection: Provides a legal framework for defending your home against creditors, ensuring that your rights are protected under the law. Empowerment: Empowers you to take control of your financial future and protect your family's well-being by utilizing available legal tools and protections. Community Benefit: Contributes to the stability of the community by preventing foreclosures and maintaining homeownership rates, fostering a sense of belonging and security.

Question and Answer Section

Here are some common questions and answers about Homestead Declarations:

Q: What types of debts are protected by the Homestead Declaration?

A: The Homestead Declaration typically protects against unsecured debts, such as credit card debt, medical bills, and personal loans. It does not protect against secured debts like mortgages or property taxes.

Q: How much equity is protected by the Homestead Declaration?

A: The amount of equity protected varies by state. Some states offer relatively small exemptions, while others offer more generous protections that can shield hundreds of thousands of dollars of your home's value.

Q: Do I need to file a Homestead Declaration in every state?

A: No, some states offer automatic homestead protection, meaning you don't need to file any paperwork to claim the exemption. However, it's still a good idea to understand the rules and regulations in your state.

Q: Can I file a Homestead Declaration if I'm not a U.S. citizen?

A: The eligibility requirements for filing a Homestead Declaration vary by state. In general, you must be a resident of the state and occupy the property as your primary residence. Citizenship is not always a requirement.

Conclusion of Homestead Declaration Form: Protect Your Home Today

The Homestead Declaration is a powerful tool that every homeowner should understand and consider utilizing. It offers a crucial layer of protection against unforeseen financial challenges, safeguarding your home and providing peace of mind. By understanding your state's specific laws, filing the declaration correctly, and seeking professional advice when needed, you can take proactive steps to protect your most valuable asset and secure your family's future. The Homestead Declaration is more than just a legal document; it's a symbol of security, stability, and the enduring importance of homeownership.

Post a Comment